According to the Securities and Exchange Board of India (SEBI), 3.39 million new investors entered the stock market in January 2022. Investing in the stock market is one of the best ways to build wealth by harnessing the power of growing companies. The past two decades have seen steady growth in the popularity of the stock market. Why? Because investing in the stock market is the most significant way to strike wealth by building a large corpus over the years. Since the stock market is a dynamic sector, it comes with great risks for investors. Therefore, investing in the stock market for beginners can be a little daunting as the fluctuations in the market always remain an area of concern. The fluctuations can seriously impact your portfolio if you’re a beginner and intend to invest in the stock market. People may also face losses if they don’t invest strategically.

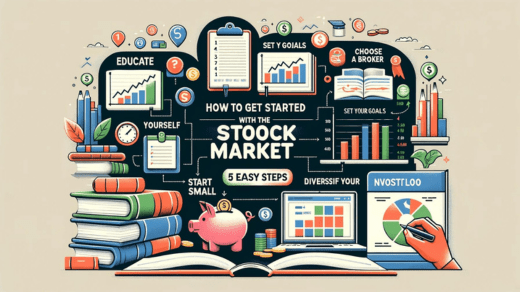

If investors are itching to get hands-on with the stock market, this guide will help them get started. Here we’ll discuss the five easy ways to help start on the stock market journey.

Five ways to get started on your journey in the stock market

The stock market is an intriguing place; the world of the stock market is like a roller coaster, and the ride is always full of fun and fear. This is the Indian stock market charm that attracts millions of investors. As a beginner, if investors are looking to invest in a trustworthy company that can give them a higher return, Reliance Retail should be their ideal option. Unlike other companies, the reliance retail share price is very moderate; they can buy one share at Rs. 3254.0. However, to invest in the company, it’s essential to follow the crucial ways mentioned below.

- Consult with the right broker

In India, people trade stocks either in listed shares or unlisted shares. stocks come with risks and high returns. As a newbie investor, one must consult with a broker to help with the investment journey. The broker will guide and open a Demat account to make the trading more convenient. Further, with his help, investors will get real-time market insights and data. In the stock market, information is crucial, and the latest research can mean the difference between a profitable or loss-making trade.

2. Recognise your investment essentials

Before starting trading in the stock market, investors must understand the requirements and investment goals. Further, they also need to figure out how much to invest. As a newbie, they must start investing with a small amount. The more they learn about stock market investment, the better the returns they will make in the future.

3. Analyse investment tactics

Once the investors are done learning the investment capacity, they must be able to analyse the stock market scenario to plan the best investment strategy. They must identify stocks that are best suitable for their needs and requirements. For instance, if an investor wishes for an extra income source, investing in dividend-paying stock will be an ideal choice for him. Similarly, preferring growth stocks is the best strategy for investors who want to raise their capital.

4. Invest at the right time.

The stock market is dynamic in nature, and price fluctuations keep happening. Since the market is unpredictable, it’s essential to know the right time to invest in the stock market. Investors often overlook this strategy, so it’s necessary to understand the market for a better return. As an investor, he must buy the stocks at a lower price level that will ultimately increase the profit in the future. Similarly, selling the stocks when it is trading at the highest price will be profitable for them.

5. Build and manage the diverse portfolio

For every beginner investor, building a portfolio is a must as it will help them tackle the ups and downs in the stock market. Undoubtedly, the stock market is enormous, and realities alter every second. To bear the risk, building and analysing a portfolio is required to reduce potential losses and increase profits. However, it shouldn’t mean that they need to react to every change in the price level; they just need to be informed of the large trends in the market.

With these five simple steps, any beginner investor can easily start their investment journey in the stock market confidently. Further, they can grow in the stock market by maintaining discipline in executing their investment strategy. Being a newbie investor, if you’re looking to buy unlisted shares in India, Stockify should be your ideal partner. They can guide you throughout the investment journey and help you buy the proper unlisted share in India. Connect with them to ease your investment journey in the stock market.